Corvus Gold Acquires Mother Lode Property from Goldcorp, 10 Kilometres Southeast of the North Bullfrog Project, Nevada

June 6, 2017

Mother Lode Property Highlights

- Historic resource of 430,000 ounces at 1.6 g/t gold*

- Total of 172 exploration drill holes outlining historic resource

- Past heap leach production of 34,000 ounces gold at an average grade of 1.8 g/t

- Numerous drill intersections of +2 g/t gold over +10 metres in thickness

- Past mining operation fully reclaimed with State and Federal sign off

* Quoted historical resource numbers are not NI 43-101 estimates

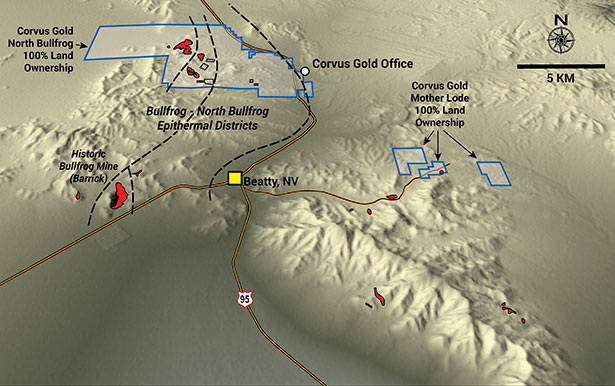

Vancouver, B.C… Corvus Gold Inc. (“Corvus” or the “Company”) - (TSX: KOR, OTCQX: CORVF) announces the agreement to acquire the Mother Lode property in Nevada from Goldcorp USA Inc. (Figure 1). Corvus Gold plans to purchase 100% of the Mother Lode property, covering approximately 250 acres and containing a historic (non-NI-43-101 compliant) resource of 8.5Mt at a grade of 1.6 g/t gold totaling 430,000 ozs of gold. In addition, Corvus Gold staked two additional adjacent claim blocks to Mother Lode totaling 1,040 acres, covering areas of exploration and development potential. The Mother Lode property approximately 10 kilometres from Corvus Gold’s North Bullfrog project with potential for a large satellite operation.

Figure 1 Map showing newly acquired Mother Lode property location in relation to North Bullfrog Project

Terms of the transaction include:

- Issuance of 1,000,000 Corvus Gold common shares (with a deemed price of $0.81 per share, based on the closing price on June 5, 2017, with the closing of the transaction expected to occur on June 9, 2017)

- The property is subject to an NSR in favour of Goldcorp. The NSR pays 1% from production at the Mother Lode property when the price of gold is less than USD $1,400/ounce and an additional 1% NSR for a total of 2% NSR when gold price is greater than or equal to USD $1,400/ ounce

Jeff Pontius, President and CEO of Corvus said, “The acquisition of the Mother Lode property is an important addition to Corvus Gold. Mother Lode hosts a series of thick, shallow dipping, stacked mineralized bodies averaging 1.6 g/t gold. These mineralized bodies are open for expansion along with a number feeder structures averaging over 3 g/t gold. We intend to initiate a substantial exploration and resource development program at Mother Lode this summer. Corvus Gold is also on track to complete its update of the North Bullfrog resource and Preliminary Economic Assessment study this fall. 2017 will be an important year for Corvus Gold with several major company expansion projects taking place.”

Mother Lode Opportunity

The Mother Lode deposit was mined in the late 1980’s when gold price was about $400/ounce. Low gold prices made the operation uneconomic and resulted in the closure of the operation in 1989 after less than 3 years in operation which produced 34,000 ounces of gold. The Mother Lode project is similar in age to the historic Bullfrog Mine and the newly discovered North Bullfrog project and is hosted in both Tertiary volcanic-sedimentary rocks and Paleozoic sedimentary rocks. The mineralization occurs as low angle, north dipping, near surface, tabular bodies of mixed sulfide and oxide mineralization. Key structural controls in the deposit appear to be a series of north northwest high angle structures which have acted as conduits for mineralizing fluids (similar to the YellowJacket deposit at North Bullfrog). An important untested target for additional high-grade mineralization is the intersection of the major, low angle east-northeast trending Fluorspar Canyon Fault Zone and the high-angle N-NW trending feeder structures approximately 50 metres below the existing Mother Lode deposit.

Nearly all of the 172 development and exploration drill holes on the property were drilled vertically and are less than 200 metres deep. This vertical drilling pattern was not optimum for defining the steeply dipping, high-grade structural systems, although some did intersect a couple of these zones (ML-086: 24m @ 4.4g/t Au; D-442: 24m @ 5.1g/t Au; D-445: 18m @ 7.4g/t). The current deposit has three defined tabular bodies that are all currently open for expansion down dip and to the west.

The current Mother Lode land package is limited in size, but potentially adequate for possible satellite mining project and surface processing facilities. Corvus is also considering alternatives where higher-grade mineralization could be trucked to the planned Corvus mill facility at the North Bullfrog Project which is approximately 20 miles away by road. Preliminary column test, heap leach metallurgical work on the deposit indicates heap leach potential for the lower grade material. The Mother Lode project has excellent access lying along a major county graveled road and with grid power three kilometres away.

As Corvus Gold geologists and engineers review the extensive digital and hard copy database the Company will provide project and exploration target updates over the coming months. Corvus Gold has begun exploration and is planning to start the initial phase of exploration drilling on the Mother Lode project in the fall of this year.

The Toronto Stock Exchange has granted conditional approval to the issuance of the Corvus Gold common shares under the transaction.

The historic estimates for the Mother Lode property contained in this news release should not be relied upon. These estimates are not National Instrument 43-101 (“NI-43-101”) compliant. While the Company considers these historical estimates to be relevant to investors as it may indicate the presence of mineralization, a qualified person for the Company has not done sufficient work to classify the historical estimates as current mineral resources as defined by NI 43-101 and the Company is not treating these historical estimates as a current mineral resource.

About the North Bullfrog Project, Nevada

Corvus controls 100% of its North Bullfrog Project, which covers approximately 72 km² in southern Nevada. The property package is made up of a number of private mineral leases of patented federal mining claims and 865 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor as well as a large water right. The company also controls 65 federal unpatented mining claims on the Mother Lode project which totals 522 hectares which it owns 100% of.

The North Bullfrog project includes numerous prospective gold targets at various stages of exploration with four having NI 43-101 mineral resources (Sierra Blanca, Jolly Jane, Mayflower and YellowJacket). The project contains a measured mineral resource of 3.86 Mt at an average grade of 2.55 g/t gold and 19.70 g/t silver, containing 316.5k ounces of gold and 2,445k ounces of silver, an indicated mineral resource of 1.81 Mt at an average grade of 1.53 g/t gold, and 10.20 g/t silver, containing 89.1k ounces of gold and 593.6k ounces of silver and an inferred resource of 1.48 Mt at an average grade of 0.83 g/t gold and 4.26 g/t silver, containing 39.5k ounces of gold and 202.7k ounces of silver for oxide mill processing. The mineral resource for the mill process was defined by WhittleTM optimization using all cost and recovery data and a breakeven cut-off grade of 0.52 g/t gold. In addition, the project contains a measured mineral resource of 0.3 Mt at an average grade of 0.25 g/t gold and 2.76 g/t silver, containing 2.4k ounces of gold and 26.6k ounces of silver, an indicated mineral resource of 22.86 Mt at an average grade of 0.30 g/t gold and 0.43 g/t silver, containing 220.5k ounces of gold and 316.1k ounces of silver and an inferred mineral resource of 176.3 Mt at an average grade of 0.19 g/t gold and 0.67 g/t silver, containing 1,077.4k ounces of gold and 3,799.2k ounces of silver for oxide, heap leach processing. The mineral resource for heap leach processing was defined by WhittleTM optimization using all cost and recovery data and a breakeven cut-off grade of 0.15 g/t.

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), has supervised the preparation of the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO & President and holds common shares and incentive stock options.

Carl E. Brechtel, (Nevada PE 008744 and Registered Member 353000 of SME), a qualified person as defined by NI 43-101, has coordinated execution of the work outlined in this news release and has approved the disclosure herein. Mr. Brechtel is not independent of Corvus, as he is the COO and holds common shares and incentive stock options.

The work program at North Bullfrog was designed and supervised by Mark Reischman, Corvus Gold’s Nevada Exploration Manager, who is responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Chemex’s quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control.

For additional information on the North Bullfrog project, including information relating to exploration, data verification and the mineral resource estimates, see “Technical Report and Preliminary Economic Assessment for Combined Mill and Heap Leach Processing at the North Bullfrog Project, Bullfrog Mining District, NYE County, Nevada” dated June 16, 2015 as amended and restated May 18, 2016 which is available under Corvus’ SEDAR profile at www.sedar.com.

About Corvus Gold Inc.

Corvus Gold Inc. is a North American gold exploration and development company, focused on its near-term gold-silver mining project at the North Bullfrog and Mother Lode Districts in Nevada. In addition, the Company controls a number of royalties on other North American exploration properties representing a spectrum of gold, silver and copper projects. Corvus is committed to building shareholder value through new discoveries and the expansion of its projects to maximize share price leverage in a recovering gold and silver market.

On behalf of

Corvus Gold Inc.

(signed) Jeffrey A. Pontius

Jeffrey A. Pontius,

President & Chief Executive Officer

Contact Information: Ryan Ko

Investor Relations

Email: info@corvusgold.com

Phone: 1-844-638-3246 (toll free) or (604) 638-3246

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the potential for new deposits and expected increases in a system’s potential; anticipated content, commencement and cost of exploration programs, anticipated exploration program results, the discovery and delineation of mineral deposits/resources/reserves, the potential to develop multiple YellowJacket style high-grade zones, the Company’s belief that the parameters used in the WhittleTM pit optimization process are realistic and reasonable, the potential to discover additional high grade veins or additional deposits, the potential to expand the existing estimated resource at the North Bullfrog project, the potential for any mining or production at North Bullfrog, planned exploration and development programs at Mother Lode, potential production plans for the Mother Lode project, and potential resources at the Mother Lode project are forward-looking statements. Information concerning mineral resource estimates may be deemed to be forward-looking statements in that it reflects a prediction of the mineralization that would be encountered if a mineral deposit were developed and mined. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company may produce or plan to produce, the Company's inability to obtain any necessary permits, consents or authorizations required for its activities, the Company's inability to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, and other risks and uncertainties disclosed in the Company’s 2016 Annual Report on Form 10K and latest interim Management Discussion and Analysis filed with certain securities commissions in Canada and the Company’s most recent filings with the United States Securities and Exchange Commission (the “SEC”). All of the Company’s Canadian public disclosure filings in Canada may be accessed via www.sedar.com and filings with the SEC may be accessed via www.sec.gov and readers are urged to review these materials, including the technical reports filed with respect to the Company’s mineral properties.

Cautionary Note Regarding References to Resources and Reserves

NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this press release have been prepared in accordance with NI 43-101 and the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resource and Mineral Reserves, adopted by the CIM Council on May 10, 2014 (the “CIM Standards”) as they may be amended from time to time by the CIM.

United States investors are cautioned that the requirements and terminology of NI 43-101 and the CIM Standards differ significantly from the requirements and terminology of the SEC set forth in the SEC’s Industry Guide 7 (“SEC Industry Guide 7”). Accordingly, the Company’s disclosures regarding mineralization may not be comparable to similar information disclosed by companies subject to SEC Industry Guide 7. Without limiting the foregoing, while the terms “mineral resources”, “inferred mineral resources”, “indicated mineral resources” and “measured mineral resources” are recognized and required by NI 43-101 and the CIM Standards, they are not recognized by the SEC and are not permitted to be used in documents filed with the SEC by companies subject to SEC Industry Guide 7. Mineral resources which are not mineral reserves do not have demonstrated economic viability, and US investors are cautioned not to assume that all or any part of a mineral resource will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade without reference to unit amounts. The term “contained ounces” is not permitted under the rules of SEC Industry Guide 7. In addition, the NI 43-101 and CIM Standards definition of a “reserve” differs from the definition in SEC Industry Guide 7. In SEC Industry Guide 7, a mineral reserve is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made, and a “final” or “bankable” feasibility study is required to report reserves, the three-year historical price is used in any reserve or cash flow analysis of designated reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. U.S. investors are urged to consider closely the disclosure in our latest reports and registration statements filed with the SEC. You can review and obtain copies of these filings at http://www.sec.gov/edgar.shtml. U.S. Investors are cautioned not to assume that any defined resource will ever be converted into SEC Industry Guide 7 compliant reserves.

This press release is not, and is not to be construed in any way as, an offer to buy or sell securities in the United States.